Comprehending the Major Risks of Investment

With the improved strategies as well as digitalization allowing people to invest, it is advisable to understand the various risks involved. Investment is all about maximizing the returns, while recognizing and managing the risks and, therefore, it’s important to know what is risk appetite as well as the investment risks. They include economic and market risk factors, risks touching on inflation, and even simple operational errors. In order to determine the possible risks oriented towards any given investment, the appropriate measures have to be conducted.

As mentioned on the title, this article will focus on the investors’ major risks and how these can be lessened or avoided.

Note: The risks outlined in this report are not extreme and are intended for informational purposes only. The specific risks you undertake will depend on the particular categories of assets and financial instruments you seek to invest in. There are other risks such as risk of currency exchange, risk of company’s cash inflow, the risk of political intervention / intolerance i.e. mercantilism, the geographic risk, and many more.

With the advancement of technology, more people are getting involved in investing as it has become easier. In this case, first-time investors need to be educated on what risks they are taking when investing their money. Your risk profile is determined by your personal financial position – your income, savings, expenses, geographical area and so on – in conjunction with investment climate, cultural culture, and investment objectives. This profile will help articulate where you stand, in terms of risk and return as well as risk appetite and loss aversion.

Risk and Reward: The Relation between the Two Most Basic Elements

Investing your money in financial instruments such as shares, bonds, currencies, and investment companies is promising in terms of returns. However, capital preservation risk also arises. This fact brings about the necessity of risk awareness prior to taking any decisions regarding investments. Before embarking on any investment, you should ask yourself: What are the risks that will adversely affect the returns of my investments?

One risk could be your own behavior as an investor. Let’s imagine that you trust the financial services provider, be it a broker or a bank, to manage your investment. Nevertheless, the choice and responsibility for such investments are ultimately yours. This is why it is essential that anyone who wishes to make an investment undertakes “due diligence” prior to engaging in any specific market product.

What Is Due Diligence?

Basically, due diligence is the process of investigating finances, business, legal and tax-related particulars of the target company before purchasing its shares or taking its over. It is a procedure that should be followed with any financial product one wants to invest into. In essence, it also means collecting the relevant information needed and adhering to time frames in one’s investment relations.

Investment Cost Risks.

Investment comes at a price. There are cost services that need to be paid in regard to the purchasing and maintaining of your funds, which includes the shares in investment funds. So even if the return may be seemed high on paper, there will be some waiting to do as most of the cost will have to be paid first before any profit can be generated out of the investment. Due to high risk of portion of the equity fee, cheap low costs alternatives should be sought depending on the individual’s situation.

Market Risks.

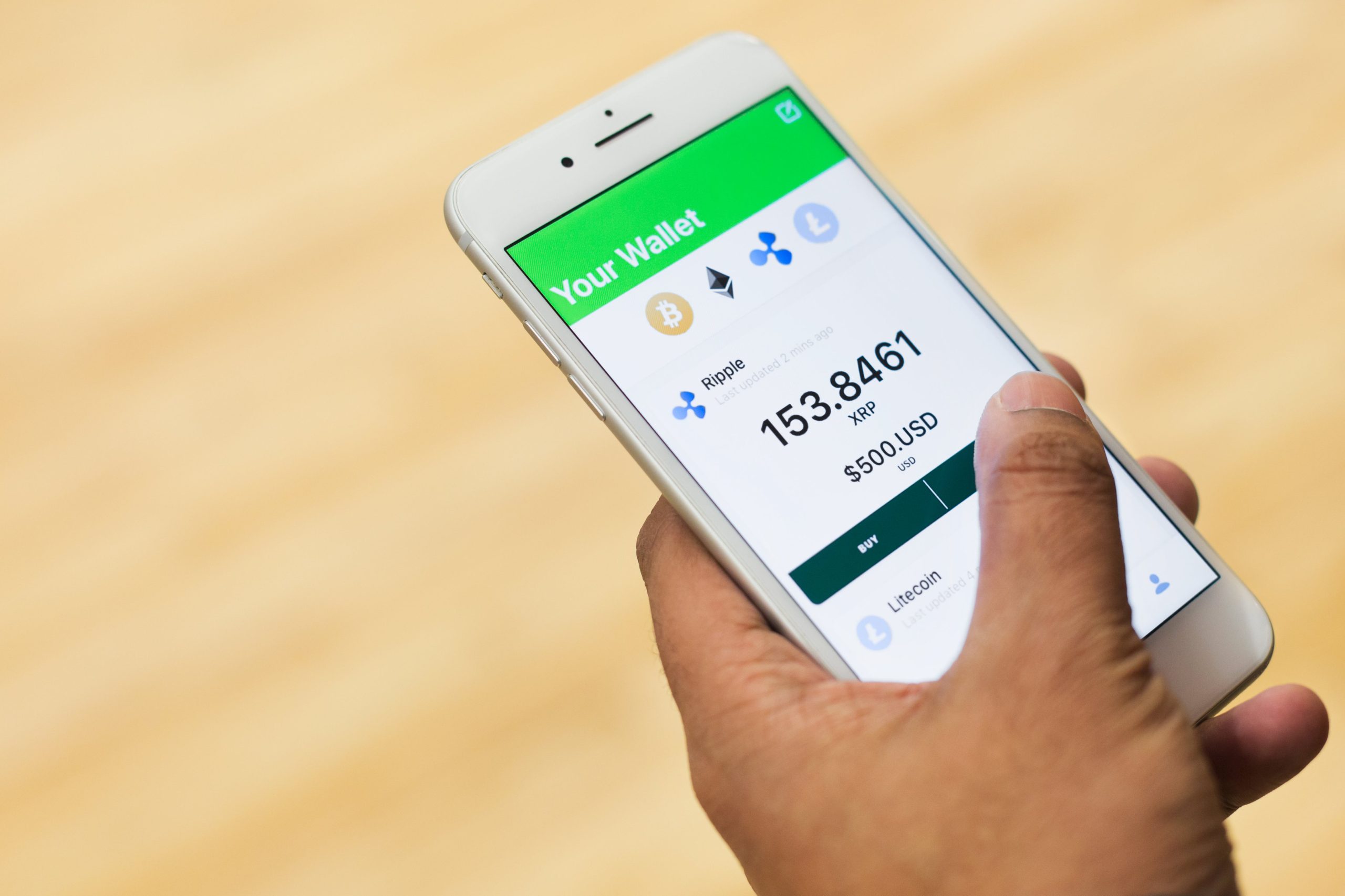

Fear of fluctuations of prices is one of the principal causes why potential investors adopt a wait-and-see approach. There is a price for each security, commodity, and even investment fund shares which can and does change owing to various factors such as the supply and demand and market yadda, etc. Volatility is a measure of an investment risk, the higher the volatility of an asset the higher is the risk. But at the same time, investors of these volatile assets like digital securities can also expect higher than average gains. It’s very important to evaluate the volatility of your investment options as well as your own willingness to take on such levels of risk.

Economic Development Risks.

The performance of any investment is also subject to the economic cycles. Some investors ignore this risk and enter into a “wrong” investment at an improper time or within an inappropriate economic cycle. At the extreme endpoints of this feature, economic risks can give birth to other investor risks i.e. the risk of default of a company.

Risks From Changes in Tax Laws.

A reason for such selection is the type of income to be earned from the financial product offered, but don’t forget that there is something called taxes on investment returns. Consequently, factoring in the above tax ramifications as you perform cost estimates on your cost budgetary expenses and be mindful of where you stay and the relevant tax provisions. If undesirable tax provisions are enacted during the investment horizon, such provisions introduce organizational risk which has an impact on your realized return.

Stock Market Risks.

A collapse of the stock market, however, is often not something that can be controlled by an individual. Factors that are external to the stock exchange like political factors, finances, international factors, national crises, etc systematically impact stock markets by affecting indices and investment funds. Other types of risks relating to markets are psychological, which usually concern people’s perceptions or gossip about the company, causing hefty market price fluctuations.